Ready To Double Your Revenue EVERY YEAR...

Guaranteed?

Just 1 ACQUISITION PER YEAR will allow you to have to business and life you have always wanted. Let us show you how.

You are here for a reason…you have always heard about growing through acquisition, but not sure where to start or you are just looking for a solid M&A professional to take this process of your plate.

Do you resonate with any of these…?

You have spent years building your business, but will you be wealthy when you sell?

You have spent years building your business. But when you look at what your business will bring when you sell, it will not match up with the lifestyle that you once dreamed about.

You first started your business with dreams of being financially wealthy, but you have since found yourself focusing only on how to grow your current business 20-30% every year.

100% growth year over year sounds so much better, doesn’t it?

You want to grow through acquisitions, but you either don’t think you have time to dedicate to acquisitions.

It takes time and energy to conduct a proper strategy and search for potential acquisition targets.

You know your business, we know ours. We are able to completely take the burden off of your hands of looking for a strategic acquisition. Think of us as an extension of your team.

After the acquisition is made, we assist with integration such that a proper Operator/CEO can be hired to run the business for you.

You think you don’t have the budget for an acquisition.

Many business owners and CEO’s think that they are not financially ready to take on an acquisition.

The truth is, I bet you do.

Some acquisitions are structured with $0 capital outlay. Others are 10%.

There are so many baby boomers retiring and willing to seller finance a significant portion AND leave equity on the table for you.

You never know when your competitor is going to let their company go for pennies on the $!

You don’t have the proper team to help you with acquisitions.

Acquisitions have normally only been reserved for large businesses with a team of highly experienced M&A advisor on staff, attorneys and accountants.

But they don’t have to be, and shouldn’t be.

If you are over $1.5M in annual revenues, you should be thinking about acquisitions.

We offer a complete acquisition team that provides all services necessary under 1 roof, at a fraction of the cost.

You are ready to transform your company into a high growth business model that will provide you the profits (and exit) you have literally always dreamed about.

Can you imagine what your business (and life) would be like with that?

Let’s look at two hypothetical HVAC companies to emphasize the difference of organic growth alone vs acquisitions alone (very conservative margins & multiples):

HVAC Company A

Year 1 – $5M annual revenues, 15% net profit – $750k/year.

Company A grows organically at 15% average per year.

Year 2 – $5.7M revenues. 15% net profit – $855k/year.

Year 3 – $6.6M revenues. 15% net profit – $990k/year.

Year 4 – $7.6M revenues. 15% net profit – $1.1M/year.

Year 5 – $8.7M revenues. 15% net profit – $1.3M per year.

Owner sells company for and nets $5M

HVAC Company B

Year 1 – $5M annual revenues, 15% net profit – $750k/year.

Company B acquires 1 company of equal size every year.

Year 2 – $10M revenues, 12% net profit – $1.2M/year.

Year 3 – $20M revenues, 12% net profit – $2.4M/year.

Year 4 – $40M revenues, 11% net profit – $4.4M/year.

Year 5 – $80M revenues, 10% net profit – $8M/year.

Owner sells company for $50M.

Minus maybe 30% for investors, nets $35M.

WOULD YOU RATHER:

NET $1.3M PER YEAR AND $5M FROM A SALE OR…

NET $8M PER YEAR AND $35M FROM A SALE?

THE ANSWER IS OBVIOUS.

Most CEO’s and business owners are not aware of the simplicity and availability to acquire companies and accelerate company growth.

Many times we are stuck in the day to day of our current operations and unable to see outside the walls of our current business to vast the opportunity that acquisitions presents to us.

Many times these businesses are just shutting down…which is the last thing the seller wants.

If this makes sense, then let’s discuss how we can help you accelerate your companies growth.

How the 1Acquisition.com program

helped Loren go from $1.8M to over $7M…

in less than a year.

Situation

When Loren first came to us, he had already established his company as a potential rising star in his geographic marketplace. He had a good business that was providing him a relatively decent living.

His company was already very successful in it’s own right. But Loren started looking at his retirement goals, he was not going to be able to achieve them by relying on 20-30% organic growth every year.

Solution

We identified a strategic acquisition plan that not only included other HVAC companies in his surrounding area, but also targeted synergistic “complimentary” B2B commercial service businesses and vertically aligned acquisitions.

We located a plumbing business that was already providing installation and services to very similar clients in the same town.

We contact the owner and was able to create a win-win solution where Loren bought the industrial plumbing company.

Results

Not only did Loren purchase a $3.1M annual revenue company with $800k EBITDA for $1.1M, over night increasing his revenues from $1.8M to $5M, but because of the synergies between the two companies…

Both companies will have a synergistic increase of at least $1M in new business each. In just about 1 year, Loren will take his company from $1.8M to over $7M in revenue.

We are now searching for a $7-$10M acquisition for Loren that will allow his company to have gone from $1.8M to over $14M in about 2 years.

will help you grow your business faster than you ever dreamed…

HOW DO WE BRIDGE THE GAP BETWEEN WHERE YOU ARE NOW AND WHERE YOU WANT TO BE?

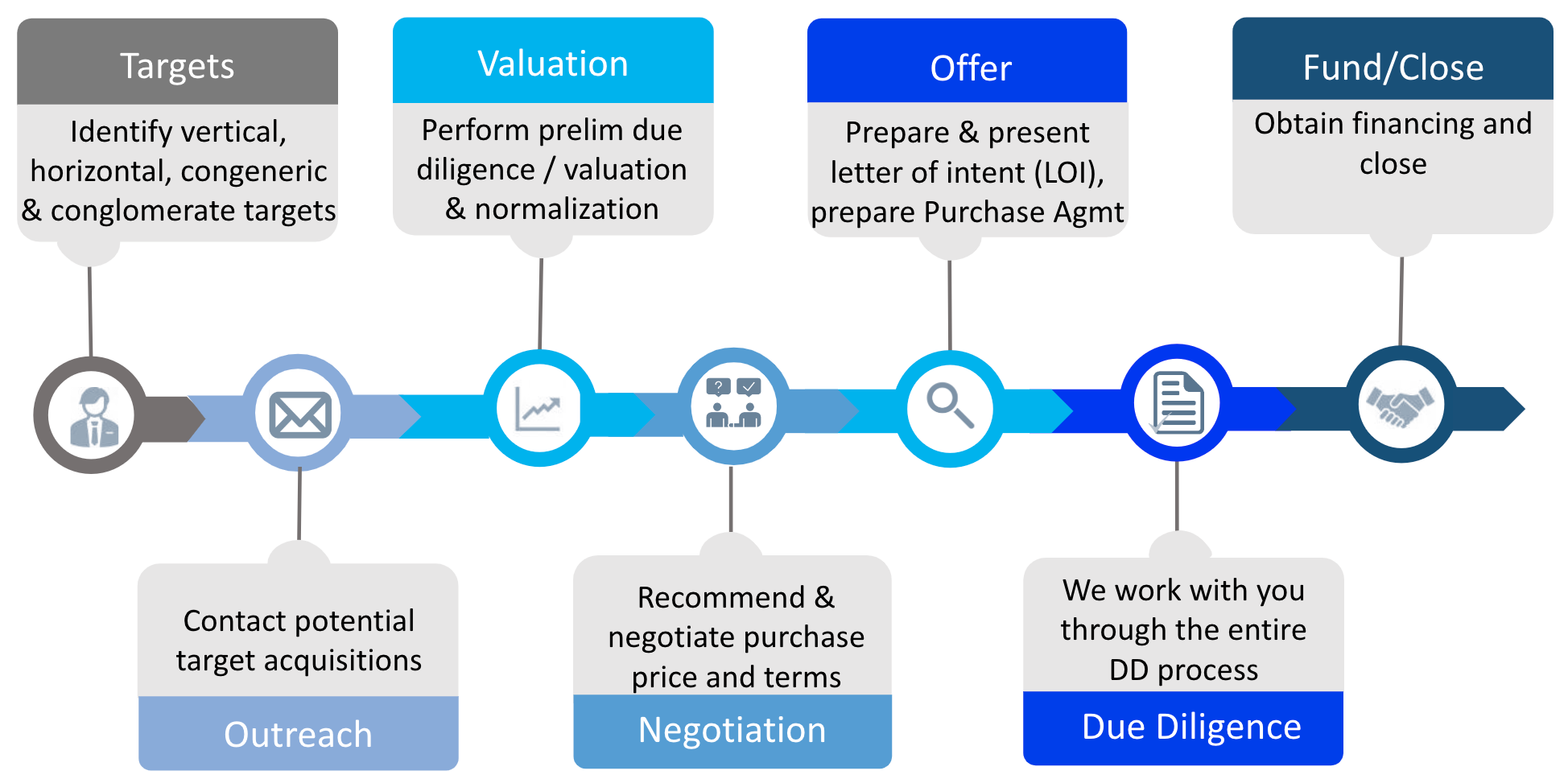

Target Identification

In the target identification phase, we are developing your acquisition strategy. Here we work together to determine the types, industries, geography and size of acquisition to pursue.

We determine whether vertical, horizontal, conglomerate or congeneric targets to include in your strategy. Ultimately, your exit strategy goals will dictate the direction for a comprehensive acquisition strategy.

Outreach

We employ a number of methods to obtain contact information for business owners that match our target criteria. This may be data list providers, industry websites, brokerages, conference providers, google and a number of other sources.

We then implement a direct response campaign to contact owners via email, mail or phone. Goal is to identify potential acquisition targets that are considering selling, ideally motivated.

Valuation

Once initial interest has been expressed by a potential buyer, we sign an NDA and obtain relevant company financial and tax history. We then perform an initial valuation to determine “Go / No-Go” on the direction of negotiations with the seller.

Our comprehensive valuation techniques take into effect financials, operations, personnel, growth potential and analyzes the RISK associated with the acquisition; which greatly impacts purchase price.

Negotiation

We consult with you and then begin the negotiation process with the seller. Many sellers are baby boomers that are very motivated and allow for us to settle on a beneficial price, while still solving the sellers main concern – typically employees & legacy.

Offer

We then prepare a Letter of Intent (LOI) and present to seller.

We prepare the purchase and sale agreement for utilization when the due diligence phase has ended.

Due Diligence

The due diligence phase takes about 45-90 days.

In this phase, we work with you to perform due diligence in finance, operational and people capital to ensure that the business is being sold as advertised.

Fund & Close

We can assist with financing as we work directly with approved lenders. After close, we can assist with the integration phase of transitioning to new ownership successfully.

Meet Our Founder & CEO

Patrick is revolutionizing the business industry by bringing acquisition services that were once thought to ONLY be for the big $100M+ players to the small and medium sized business owners.

Successful 7, 8 and 9 figure CEOs and Business Owners come to us when they’re ready to scale their businesses faster than ever before dreamed by adding acquisitions to their growth platform. We solve the conventional need for an in house acquisitions team.

Patrick’s zone of genius is twofold – developing an acquisitions strategy that will allow for maximum growth in the smallest time and negotiations with sellers to create the most advantageous purchase price and terms.

He is not one of these theoretical guys. Patrick actively owns and acquires companies of his own as well, is involved in a number of roll up strategies in service and health industries and is also a Co-Founder in a Private Equity Group that is growing very fast.

Once you experience the growth and new income from your first acquisition, you will be hooked.

Let’s Do This!

We provide the strategy and turn key consulting services for you to grow leaps and bounds through acquisitions!